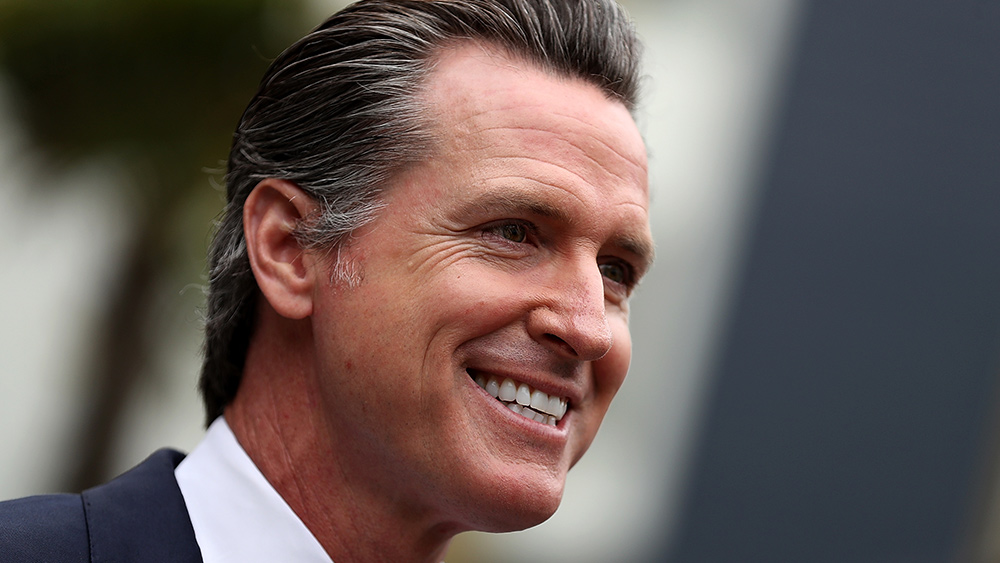

Gavin Newsom lobbying for SVB bailout while failing to disclose personal ties to bank – report

03/17/2023 / By News Editors

California’s Democrat Governor Gavin Newsom has around a quarter of a million dollars being held in the Silicon Valley Bank (SVB) that recently collapsed.

(Article by Kelen McBreen republished from Infowars.com)

While this fact was conveniently withheld, Newsom simultaneously promoted the Biden administration bailing out SVB customers with more than the $250,000 limit covered by Federal Deposit Insurance Corporation (FDIC) insurance.

It’s interesting that Newsom seems to have just above the threshold typically covered by the FDIC in SVB, but the same is true for more than 90% of the bank’s clients.

On Sunday, Newsom’s office issued the following statement regarding Biden’s handling of the banking crisis:

“The Biden Administration has acted swiftly and decisively to protect the American economy and strengthen public confidence in our banking system. Their actions this weekend have calmed nerves, and had profoundly positive impacts on California — on our small businesses that can now make payroll, workers who will get their paychecks, on affordable housing projects that can continue construction, and on non-profits that can keep their doors open tomorrow. California is a pillar of the American economy, and federal leaders did the right thing, ensuring our innovation economy can continue to grow and move forward.”

Meanwhile, The Intercept‘s Ken Klippenstein revealed Tuesday that three wineries owned by Gavin Newsom are listed as clients on the SVB website.

If that close financial tie isn’t suspicious enough, Klippenstein also reported an SVB president sits on the board of Newsom’s wife’s charity the California Partners Project and that SVB gave $100,000 to the charity in 2021.

It’s possible Newsom played a major role in convincing the Biden administration to bail the bank out as he revealed in a Saturday statement, he’d “been in touch with the highest levels of leadership at the White House and Treasury.”

Twitter financial guru Tara Bull accurately pointed out Newsom appears to be taking a page out of his Aunt Nancy Pelosi’s playbook by engaging in shady business dealings.

She also noted the governor’s same wineries with money in SVB were kept open “while small businesses were forced to close during the pandemic.”

Gavin Newsom took a page right out of his Aunt Nancy Pelosi’s book, lobbying for bank bailouts without disclosing his hefty investment.

This is the same guy who kept his winery open while small businesses were forced to close during the pandemic.

They get to play by a separate… https://t.co/1J7P0Fhy8Z

— TaraBull? (@TaraBull808) March 14, 2023

Journalist and podcast host Glenn Greenwald joked about Newsom’s assets being “protected by the Biden Admin’s acts” in a tweet on Tuesday.

Barney Frank helped lobby to rollback Dodd-Frank in 2018 to exclude the now-failed bank on whose Board he sits.

In other good news for Dems, Gavin Newsom had his assets protected by the Biden Admin’s acts this weekend, so congrats to him. https://t.co/bJY0Ozw9H6

— Glenn Greenwald (@ggreenwald) March 14, 2023

The corruption of the modern elite is more brazen than ever as the establishment makes its shift from semi-Democratic to full-on totalitarian.

Read more at: Infowars.com

Submit a correction >>

Tagged Under:

assets, bailout, bank bailout, bank collapse, biased, Biden administration, California, collapse, corruption, financial collapse, Gavin Newsom, investment, Silicon Valley Bank, SVB collapse

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2022 CurrencyCrash.News

All content posted on this site is protected under Free Speech. CurrencyCrash.News is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. CurrencyCrash.News assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.